Factors affecting property insurance premiums

Contents |

[edit] Introduction

Buildings and contents insurance can provide owners with a level of security, and potentially, remuneration following adverse events such as fire, flooding, settlement, structural collapse and public liability.

However, buildings insurance can be costly and a drain on financial resources. It may therefore be in the interests of owners to select and adapt their policies to ensure the best cover at the most affordable cost.

There are several factors that can affect the ‘premium’ – the annual cost of the insurance policy. These include:

[edit] Multi-year cover

This is the insurance equivalent of buying in bulk. At the outset, it may be possible to arrange a longer period of cover, e.g three years as opposed to annual renewal. This could bring a discount in the region of 5-10% off the premium.

[edit] Selecting the perils covered

Adjusting the extent of the perils covered may also reduce premiums. For example, some policies offer cover against vandalism, but a farmhouse on a remote hillside, or a townhouse in a gated development may be at far less risk of vandalism than other properties. It may therefore be possible to exclude vandalism from the policy and thereby reduce the cost of the premium. The same may apply to perils such as riot and malicious damage, impact by aircraft and falling trees.

[edit] Adjusting the extent of cover

If the property contains expensive jewellery, fine furniture or works of art, it may be possible to reduce the premium by moving these to another location e.g a bank vault or storage facility.

[edit] Reducing the excess

Generally, insurance policies have an ‘excess’ to be paid in the event of a claim. The excess is the amount the insured has to cover themselves before the policy pays out. If the policy has an excess of £500, and water leakage causes £1,000 of damage, the insured will only get £500 from the policy as they have to bear the £500 excess. If on the other hand the damage amounts to £400, it would not be worth making a claim (although the insurer should be notified of the event). The higher the excess the insured is willing to bear, the lower the premium will be.

[edit] Group policies

People over the age of 50 may get reduced premiums through organisations such as Saga, a specialist insurer for older people. Other group policies exist, for example, for owners of historic buildings: churches may get lower premiums through the Ecclesiastical Insurance Group.

[edit] Risk management

Insurers like to see owners instigate risk management measures aimed at safeguarding a property. Where these are in place there could be lower premiums. Measures can include:

- Smoke and fire detectors;

- Fire-fighting equipment;

- Smoke venting to minimise smoke damage;

- Burglar alarms;

- Lightening protection and

- Secure approved locks.

[edit] Managed occupation

In the case of a residence, reducing the time it is left empty (e.g vacations) can lead to lower premiums. Some policies require a house or flat to be left empty for no more than 60 days per year.

[edit] Related articles on Designing Buildings

- 3D animation for insurance risk analysis.

- Building Users' Insurance Against Latent Defects.

- Collateral warranties.

- Contractors' all-risk insurance.

- Contract works insurance.

- Decennial liability.

- Design liability.

- Directors and officers insurance.

- Employer's liability insurance.

- Excepted risk.

- Flood insurance.

- Flood Re.

- Future of construction insurance.

- Indemnity to principals.

- Integrated project insurance.

- JCT Clause 6.5.1 Insurance.

- Joint names policy.

- Latent defects insurance.

- Legal indemnities.

- Legal indemnity insurance.

- Non-negligent liability insurance.

- Performance bond.

- Professional Indemnity Insurance.

- Public liability insurance.

- Residual value insurance.

- Reverse premium.

- Specified perils.

- Subcontractor default insurance (SDI).

- Warranty.

Featured articles and news

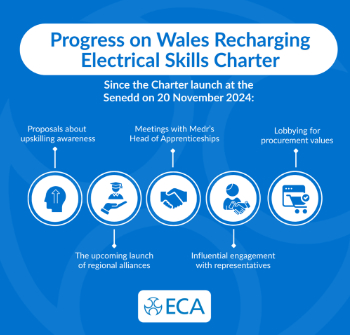

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.